Prospects for footfall on Boxing Day

Now that pre-Christmas trading is all but over for 2022, attention is now turning to the prospects for bricks and mortar retail on Boxing Day.

In all but two years over the past decade, footfall in UK retail destinations on Boxing Day has been lower than on the previous Boxing Day (in 2013 when it was +1.7% higher than in 2012 and in 2015 when it was +4.5% higher than in 2014).

A key driver of this is the steady migration of spend online which now means shoppers can participate in Boxing Day sales without the need to make trips to stores, but instead capture bargains from the comfort of their living room. So rather than purely for shopping, trips to destinations on Boxing Day have become more leisure oriented, with consumers using the day as an opportunity to eat out and socialise with family and friends.

This is demonstrated by the split of footfall across Boxing Day in 2019 on what was the last normal Boxing Day pre Covid. On this day over a third of the entire day’s footfall in occurred between 12pm and 3pm in high streets and retail parks, and in shopping centres these three hours accounted for nearly a half of the entire day’s footfall. Just 8% of total footfall in high streets and 10% of footfall in shopping centres on Boxing Day 2019 was recorded pre 10am, the time of the day in previous years when shoppers would join lengthy queues to be able capture sales bargains early.

Normal shopping behaviour on Boxing Day was severely interrupted by Covid, with a huge decline in footfall of -59.3% in 2020 from Boxing Day 2019 followed by a bounce back of +48.2% in 2021 from Boxing Day in 2020. 2022 will be the first year in the past three years when normal shopping activity has resumed.

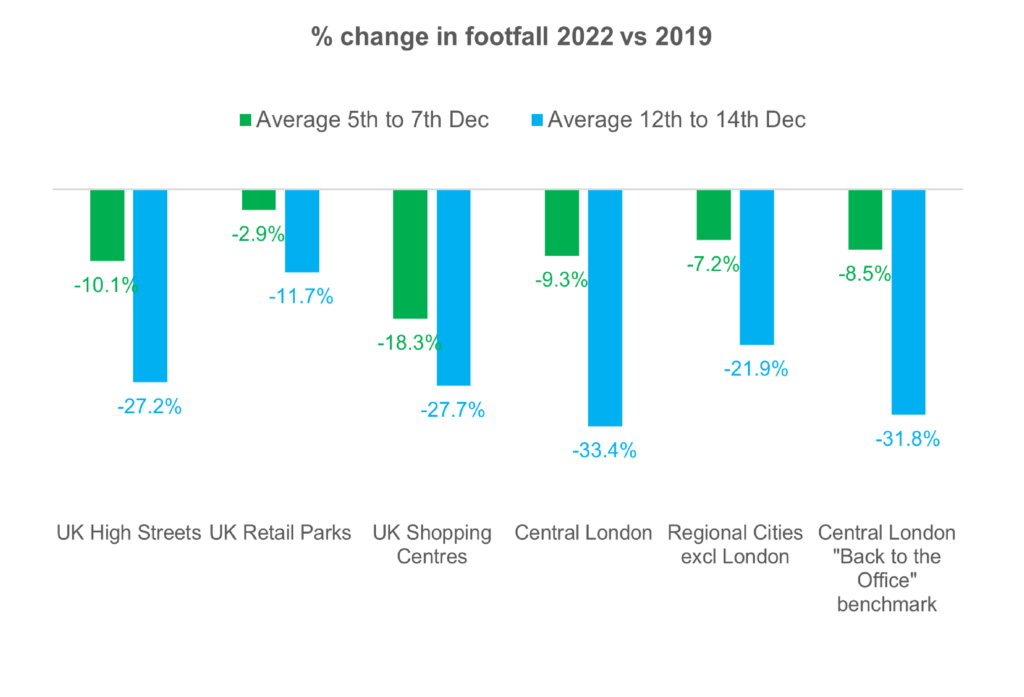

This factor, together with the fact that many retail and hospitality trips prior to Christmas will have been cancelled due to the rail strikes, will encourage consumers to make trips out on Boxing Day providing a fillip to footfall. MRI Software is therefore anticipating that footfall on Boxing Day will be circa 15% higher than in 2021, however there will still be a gap from the 2019 level which we anticipate will be circa 20%.

Boost performance with actionable insights based on AI-driven footfall analyticsFootfall Analytics

MRI OnLocation UK Monthly Commentary – March 2024

Retail footfall shows signs of stabilising as early Easter break provides a modest rise from February Each month MRI OnLocation delivers insights on retail performance for UK retail destinations. March saw a modest rise in retail footfall across the …